There are few things that we do in life that don’t or didn’t include the involvement of others to some extent. I like to refer to these “outside people” as your team. Some teams work and others don’t. In the case of the redevelopment of an historic property the right project team is critical to […]

Twinning NMTCs with HTCs Helps Produce Peabody Opera House Project

Ever since I began working in the field of historic preservation in the 1970s as grants manager and state and federal tax coordinator for the Oregon State Historic Preservation Office, historic preservation projects have always had funding gaps that needed to be filled. In the past, these gaps were filled by various methods, whether it […]

Unique Opportunities and Small LIHTC Deals

The 20 percent federal historic tax credit (HTC) is a critical tool for affordable housing development. This tax credit can be combined with low-income housing tax credits (LIHTCs) and, depending upon location, urban renewal funding and state historic incentives. This is particularly true for single room occupancy (SRO) housing, which is often located in former […]

What’s on Top? Rooftops on Historic Tax Credit Projects

An often overlooked element in historic rehabilitation projects is what’s on top of the building. As the demand for additional square footage, mechanical considerations and new technology encroach on the use of rooftop space, it is important that developers of historic properties pay particular and early attention to what’s on top of a building, as […]

EB-5: A Source of Equity for Historic Rehab

Financing any type of real estate deal over the last couple of years has been difficult, to say the least. The EB-5 program was created by Section 610 of Public Law 102-395 on October 6, 1992. This was in accordance with a congressional mandate aimed at stimulating economic activity and job growth while allowing eligible […]

The Other Often Overlooked Review: Adaptive Reuse and Federal Section 106 Historic Process

The federal government in May announced plans to dispose of 12,218 excess properties – and that number is considered just the tip of the iceberg. These buildings include the spectrum of federal properties, including offices and warehouses. At first blush, the idea of buying a surplus government building is an attractive one.

How to Fit Contemporary Office Space into Historic Buildings

You’ve decided on new office space. You’ve picked the perfect building and signed a lease. You are ready to begin designing, right? If you have chosen a historic building, the answer is: maybe not – not if that building has interior design review, such as that required in federal historic tax credit (HTC) projects. Historic […]

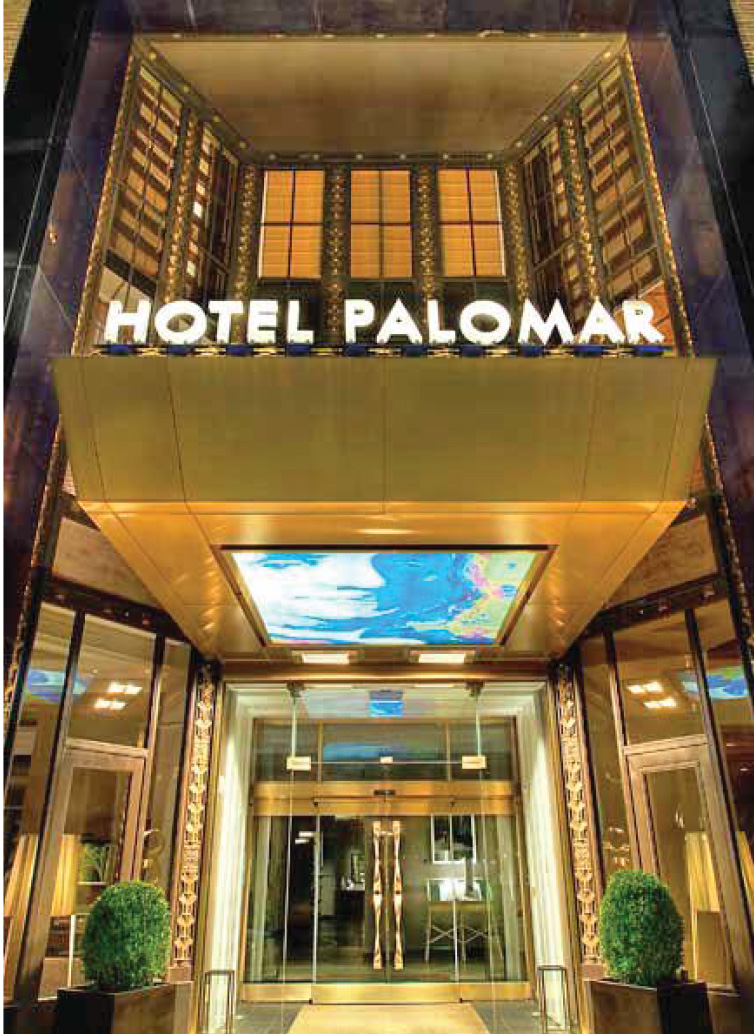

Repurposing Historic Buildings for Hotel Use: Balancing Modern Hotel Requirements with Historic Standards

The hospitality industry thrives on three basic tenets: location, service and cost, and it has developed a full range of products to capture a diverse range of customers in which emphasis on these three factors fluctuates greatly. From budget to five-star, the hospitality industry tailors its product to capture the market.

The Boutique Hoteliers and Historic Preservation: What Are They Doing Today?

The hospitality industry has always played an important role in our nation’s growth and the urbanization of the United States’ small towns and large metropolitan areas. The industry itself is reflective of the increasing mobility of American society and the modes of transportation used by Americans since the country’s inception. It is also reflective of […]