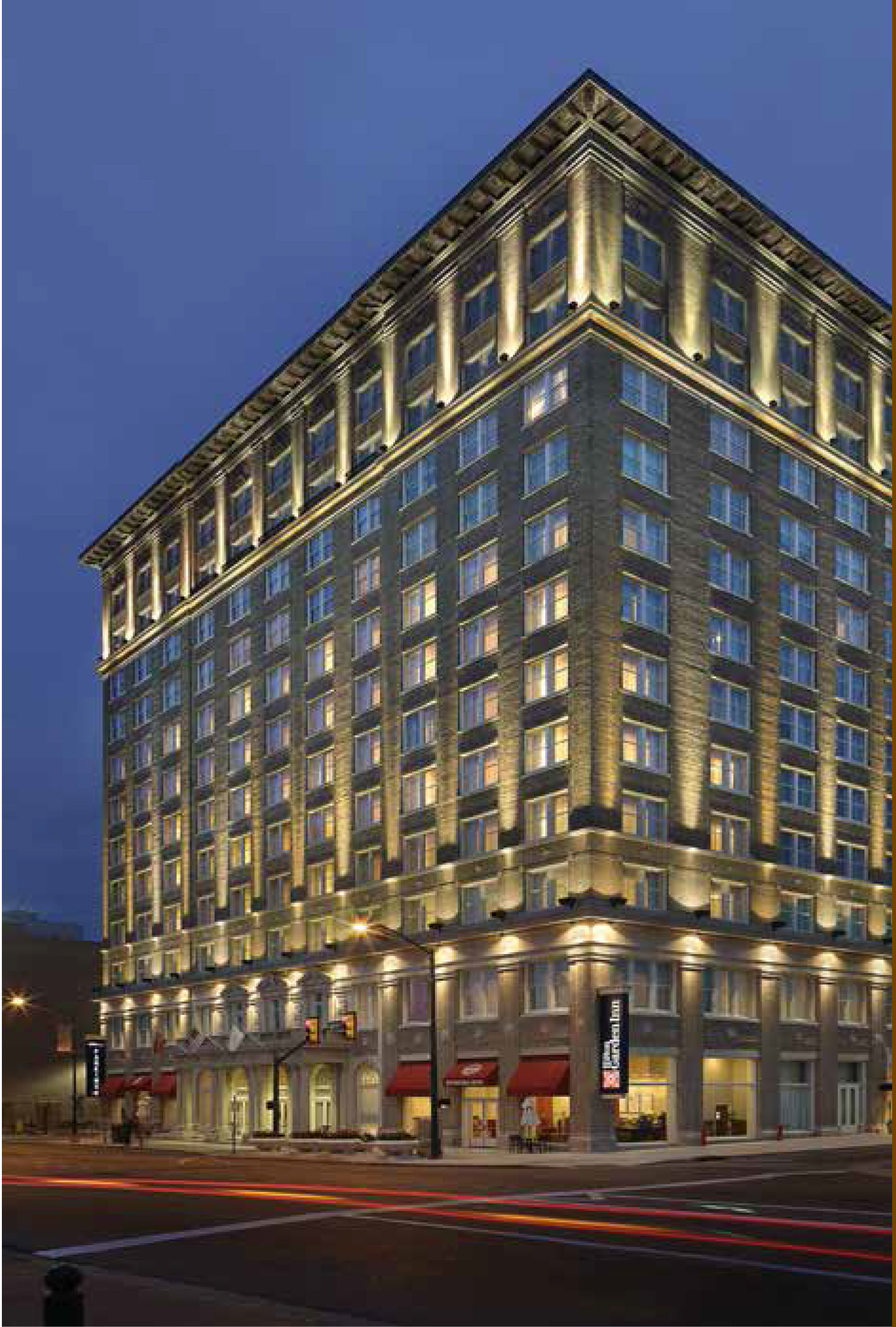

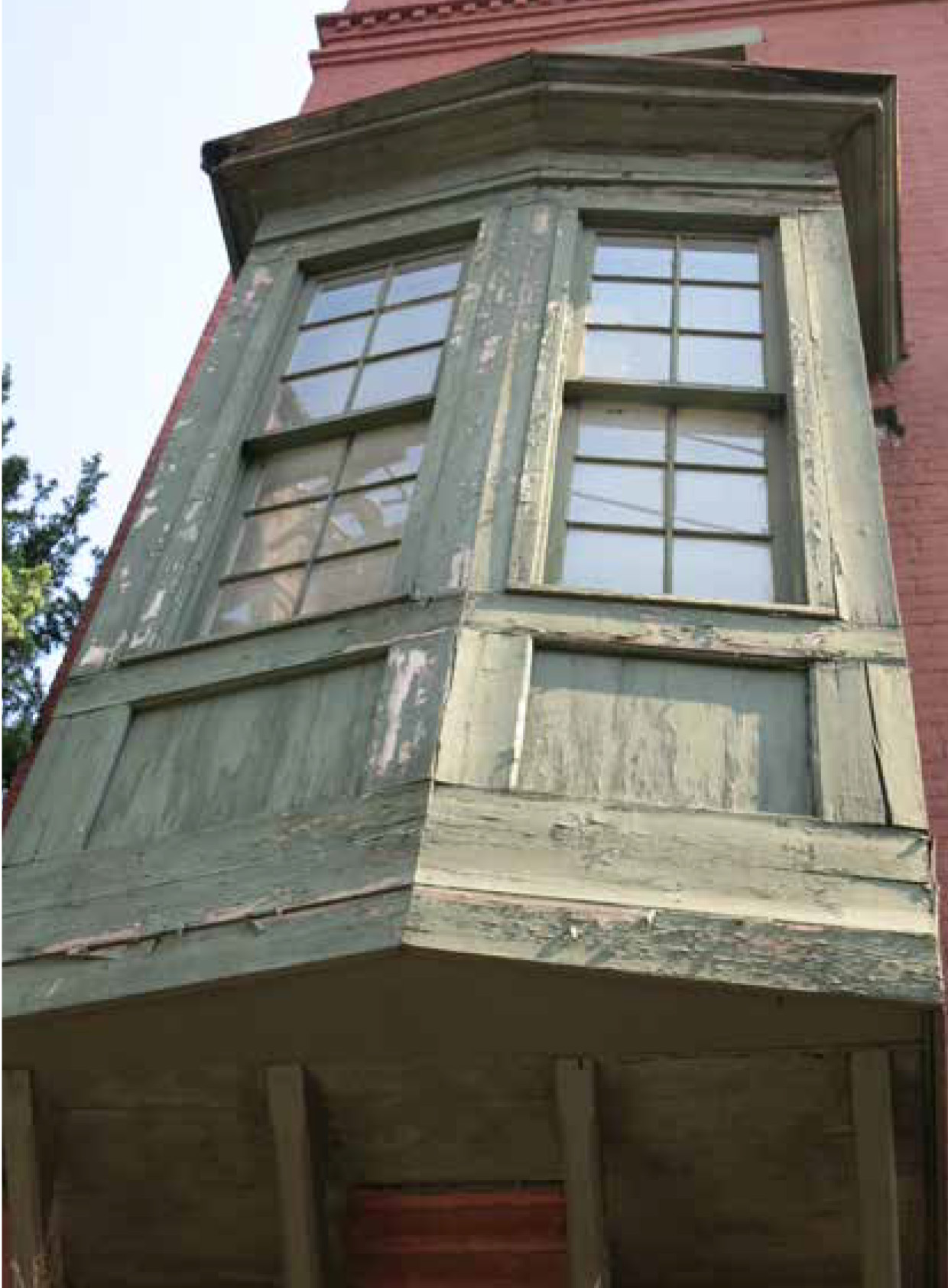

Certain building types inherently contain expansive interior spaces. Department stores, warehouses and factories, for example, can have footprints that extend a full city block. A central challenge in rehabilitating buildings with large footprints is the absence of daylight into the inner core. The adaptive reuse of such buildings, particularly for hotel or apartment use, often […]