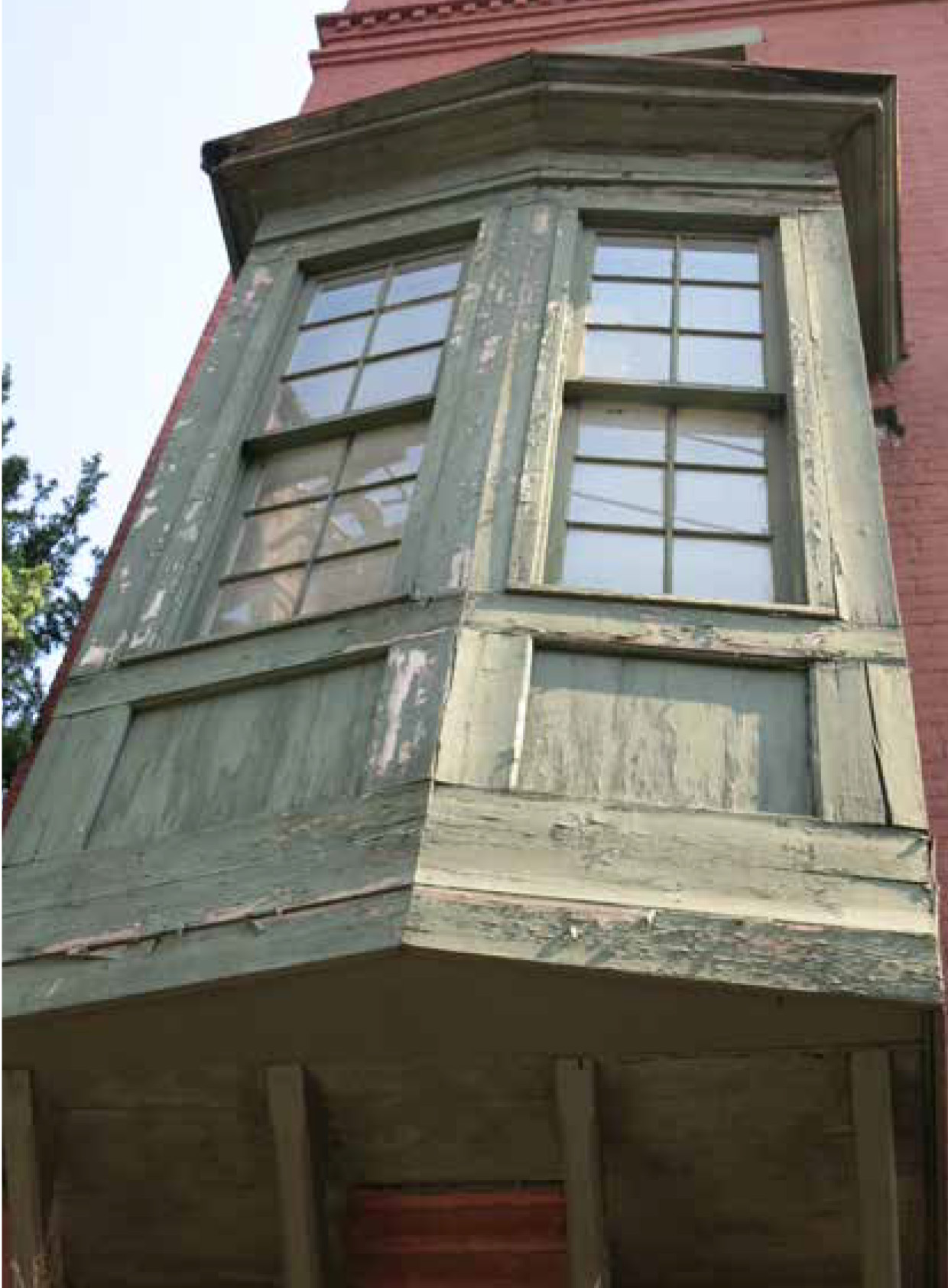

As the 40th anniversary of the federal historic tax credit (HTC) program approaches, the early days of the program come to mind: typewriter applications, carbon paper copies and 35mm photograph prints. While application procedures and technology have advanced significantly from those early days, it is also important to realize that those early tax credit projects are now at least 30 years old. […]