Heritage Consulting Group, a national firm based in Portland, Oregon and Philadelphia, Pennsylvania, has opened its Midwest office in Madison, Wisconsin. Heritage is a leading advisor to owners and developers of older and historic buildings through the development process, helping them secure federal, state and local incentives. Read more here.

News

Ray Sherman Place: Using Historic Tax Credits on Public Housing

Throughout the 20th century, different iterations of landmarks housing legislation were passed that forever changed the built environment of cities and towns across the United States. Read more here.

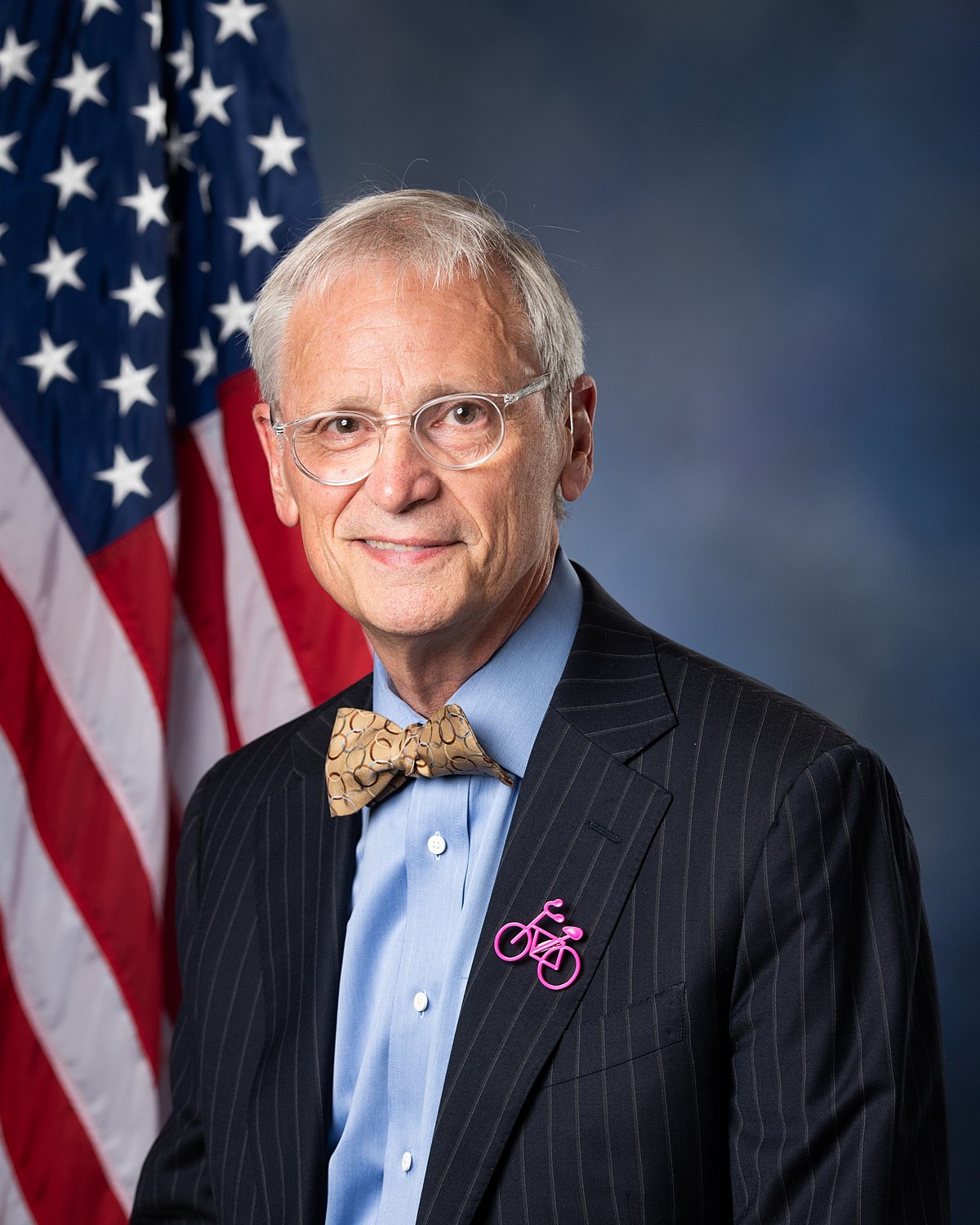

A Historic Tax Credit Conversation with Rep. Earl Blumenauer

Earlier this year, Blumenauer, alongside Rep. Darin LaHood, R-Illinois, introduced the Historic Tax Credit Growth and Opportunity Act (HTC-GO), which intended to provide relief to historic rehabilitation projects impacted by the COVID-19 pandemic. Read more here.

Historic Buildings in the Face of Climate Change and Natural Disasters

The effects of Hurricane Ida are still felt months later. Damaged caused by the flooding, heavy wind and rain, and tornadoes remains visible. Read about these damages affected historic buildings and the threat posed to historic buildings due to climate change.

Implementing Green Building Practices with Historic Preservation Requires Complicated Balance

An enduring challenge with historic tax credit- (HTC)financed properties is a high-wire act of balancing green building practices with opportunities to restore, preserve, reconstruct and rehabilitate existing structures. Read more about it here.

Rehabilitating Iconic Main Street Buildings as a Catalyst for Community Revitalization: The Ohringer Building

This past summer, the rehabilitation of the Ohringer Building in the small Pennsylvania town of Braddock was finished, culminating from decades of work by local advocates, politicians and developers to restore what the project’s developer Gregg Kander referred to as “Braddock’s Empire State Building.”

Historic Tax Credit Legislation Update from Patrick Robertson

A timely article as the Ways and Means Committee prepares to markup its tax bill that includes the HTC-GO provisions. Read more about it here.

HTC Toolbox: The Phase Advisory Option and the Rehabilitation of Bell Laboratories

In early 2021, the finishing touches were put on the rehabilitated Bell Laboratories building in Holmdel, New Jersey. Completed using historic tax credit (HTC) equity, the project, which focused on adapting the former research and development facility into a mixed-use complex, took approximately seven years to complete and encompassed the entirety of the nearly 2-million-square-foot […]

Rehabbing the Colt Armory: A Functionally Related HTC Success

In the mid-2000s, initial work began on the rehabilitation of the former Colt Armory and manufacturing complex in Hartford, Connecticut. After 15 years and three separate historic tax credit (HTC) projects, the 17-acre site consisting of eight-rehabilitated buildings was officially completed. Read more here.

Preservation and Innovation Go Hand in Hand at High-Tech, Historic Fort Worth Hotel

When the Sinclair building opened its doors for business in 1930, the 16-story Art Deco office building was a pioneer in bringing modern 20th-century amenities to Fort Worth, Texas. Read more about it here.

The Rehabilitation of Main Street USA: The Potential Impact of HTC-GO on Main Street Communities

Main Street is a major component of commercial life in America. The new legislation encourages the rehabilitation of these buildings to revitalize our Main Streets and add new chapters to their stories.

The Arrott Building: An HTC/NMTC Case Study in the COVID-19 World

HTCs and NMTC serve as excellent complements to one another, seeking to accomplish shared goals and providing flexibility in funding to developers that pair them. Read the full article here.