“Key to any feasible plan for Joe Frazier’s Gym is encouraging a sale between the current owner and an appropriate buyer,” said the report. “The Panel agreed that the ideal buyer would be a philanthropic individual or organization, or a corporate owner who would not only purchase the building but would also invest in necessary renovations.”

Subdividing Significant Interior Spaces

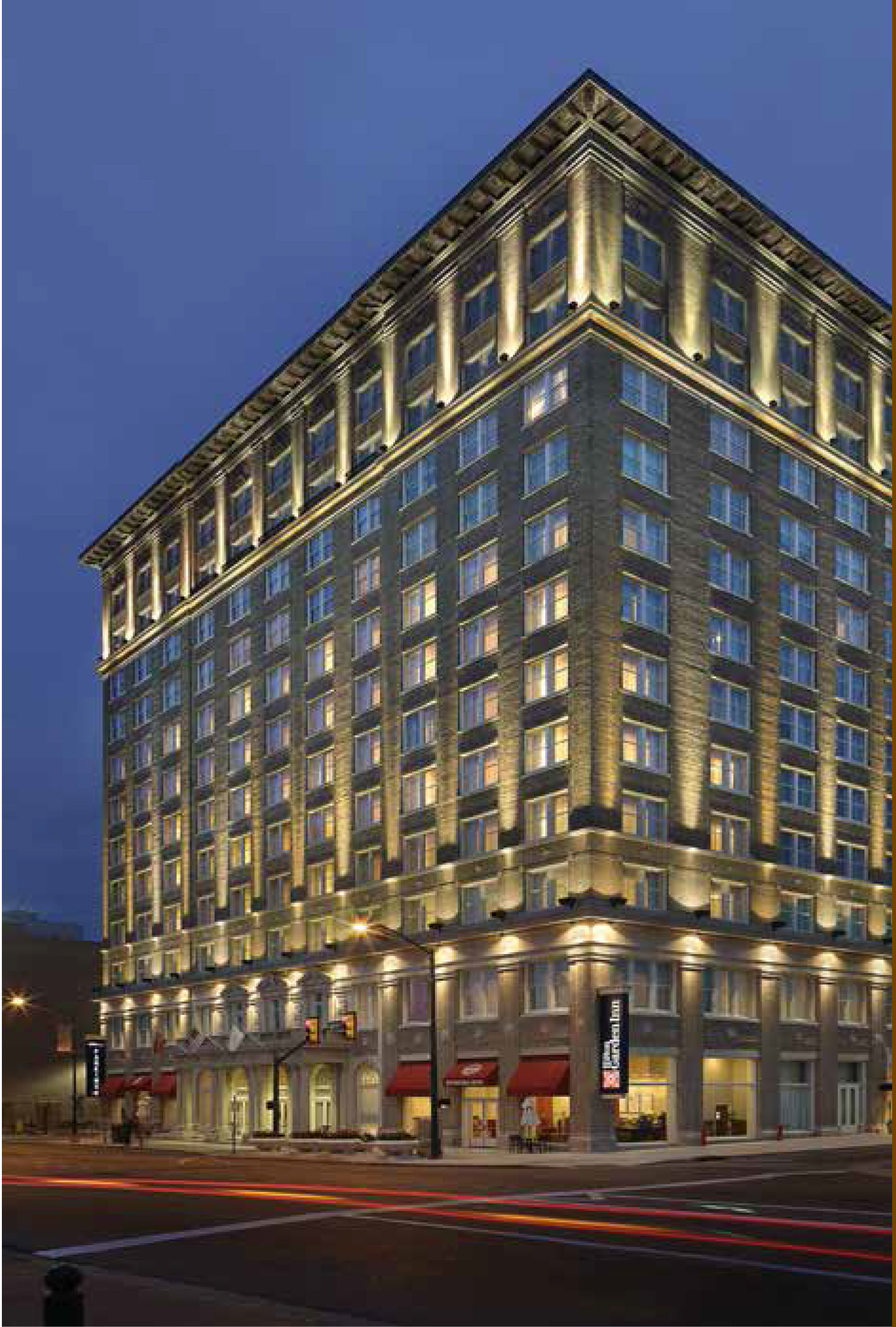

Certain building types inherently contain significant interior spaces, the character of which can be defined by their volume as well as their architectural distinction. School buildings contain cafeterias, gymnasiums and auditoriums; armories contain drill halls; hotels contain ballrooms; fraternal lodges contain ceremonial spaces; office buildings contain lobbies; and bank buildings contain monumental banking halls. The adaptive reuse of such spaces often hinges […]

The Opportunities and Challenges Presented by State Rehabilitation Credits

It is tempting to assume that if some historic tax credits (HTCs) are good, then more HTCs are better. Several public policy studies support this position. According to some studies, an active state tax credit program boosts the use of the federal program, on average, by between $15 million and $35 million in certified expenditures. Put another way, states with active […]

Can You Rehab a Rehab?

As the 40th anniversary of the federal historic tax credit (HTC) program approaches, the early days of the program come to mind: typewriter applications, carbon paper copies and 35mm photograph prints. While application procedures and technology have advanced significantly from those early days, it is also important to realize that those early tax credit projects are now at least 30 years old. […]

Challenges and Opportunities When Redeveloping Industrial Buildings

In the 40-year history of the historic tax credit (HTC) program, certain building types have become perennial targets for rehabilitation. Mills, factories, office buildings, department stores and schools are often well suited for adaptive reuse, with floor plans and finishes that lend themselves to new uses and the use of HTCs. This article, the first in a recurring series identifying the opportunities […]

National Register Listing: When Challenges Arise

Historic tax credits (HTCs) can provide a critical incentive for owners seeking to redevelop historic buildings, and the path to obtaining HTCs begins with National Register listing. For the thousands of buildings already listed in the National Register (either individually or within a historic district), the first step in the tax credit process is usually […]

Right Building, Wrong Use: Renovating Obsolete Buildings with HTCs

Or is it wrong building, right use? When is a building a good fit for a new use and when can a new use be effectively inserted into an old building? The Secretary of Interior’s Standard 1 states, “A property shall be used for its historic purpose or be placed in a new use that […]

Three Historic Tax Credit Developers’ Plans for the Future

Since 1976, federal tax incentives have been provided to encourage developers to rehabilitate historic properties rather than replace them. Over the years, the preservation tax incentives program has seen significant changes in incentives. The current federal historic preservation tax incentives program provides a 20 percent historic perseveration tax credit (HTC) for qualified rehabilitation expenditures (QREs) […]

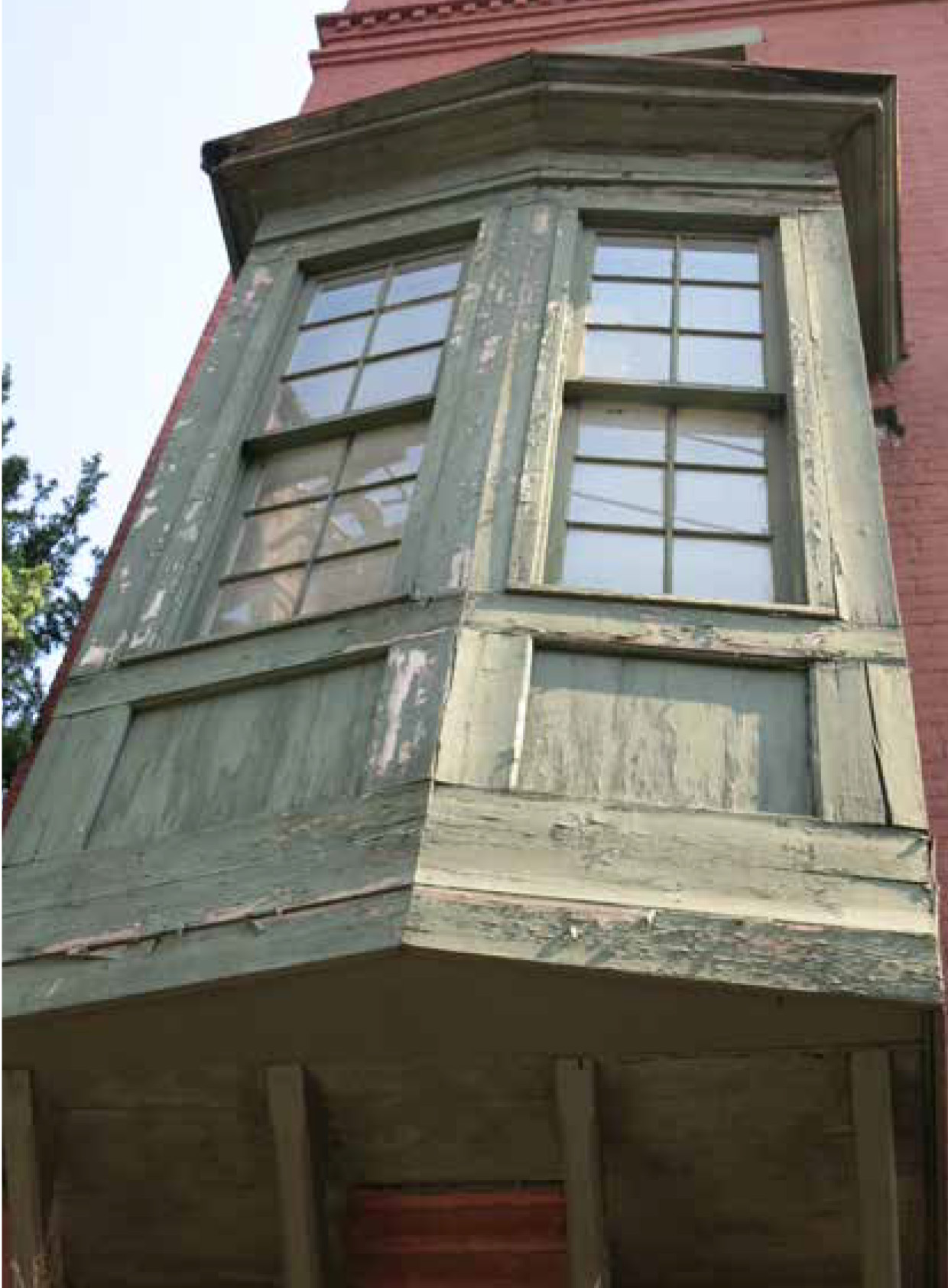

Getting Through Windows

Windows are critical to a building’s design and historic character. According to the National Park Service’s (NPS’s) Illustrated Guidelines for Rehabilitated Historic Buildings, “As one of the few parts of a building serving as both an interior and exterior feature, windows are nearly always an important part of the historic character of a building. In […]

Can You Speed Up a Historic Tax Credit Project Review?

Few things are more critical in real estate than the speed of getting a project to market. Timing can make the difference between success and failure. For historic tax credit (HTC) projects, the time when the application is under review is vexing. Program standards call for two sequential 30-day review periods: one at the State […]

Giving Back: An Update

As anyone who has undertaken the historic tax credit (HTC) certification process can attest, getting a property listed on the National Register of Historic Places can be a difficult hurdle to clear. Designation on the National Register is the gateway for eligibility to use the HTC, which means that each potential tax credit project must […]

The Non-Historic Rehabilitation Tax Credit” An Important but Overlooked Incentive

One of the lesser known rehabilitation tax credits is the 10 percent credit for non-historic buildings. The credit was created with the Tax Reform Act of 1986 at the same time as the 20 percent historic rehabilitation tax credit. Although the program has limited applicability, it is simple in concept and administration and thus can […]